Kenya to impose 16 percent VAT on Uganda milk Daily Monitor

Is There VAT on Milk in the UK? (all you need to know...)

Milk. With effect from 1 October 2012 excepted item 4A relating to Sports Drinks was introduced into the VAT Law. This item specifically standard rates all sports drinks even if they are milk.

Vat O' Milk Photo

The gap is even more significant in other countries such as Italy, where cow's milk is taxed at only 4% and plant-based alternatives at 22%, which amounts to a whopping 450% higher taxation. In other European countries, such as Denmark and France, the VAT applied for cow's milk and plant-based milk is the same (25% and 5.5% respectively).

Vat presentation

VAT on Confectionery. As mentioned above, a standard confectionery rate of 5% includes all food supplies. Standard-rated confectionery includes chocolates, sweets and candies, chocolate biscuits, and any otheritems of sweetened prepared food which is normally eaten with the fingers.'.

Milk Carton, Milk, Milk Splash, Glass Of Milk, Milk Background, Milk

We exploit the introduction of a 5% VAT on very essential food products (like fresh milk, coffee, yogurt, cheese) that occurred when an EU member state had to harmonize its VAT legislation with the EU VAT legislation. Preceding this reform, there was a removal of the zero VAT rate and imposition of 5% VAT rate on other food items that were considered less essential (juices, bottled water). We.

Kenya to impose 16 percent VAT on Uganda milk Daily Monitor

In the UK, Value Added Tax (VAT) is a tax that is added to the price of most goods and services. However, not all products will be subject to VAT, and the rate of VAT can vary depending on the item. As we've established, there is no VAT on milk. It is not subject to VAT in the UK. According to VAT Notice 701/14, milk is considered a basic.

FREE IMAGE Milk is poured into a glass Libreshot Public Domain Photos

Yes, there is always VAT on alcoholic drinks at the standard rate of 20%. VAT on wine. Yes, unfortunately wine is subject to standard-rated VAT at 20%. VAT on coffee. If you were buying coffee beans, ground coffee, or instant coffee to prepare drinks at home then they're zero-rated.

Milkadamia Unsweetened Barista Milk Milk Pick

Zero-rated VAT applies to foods and ingredients that are sold for home cooking and baking purposes. Sweeteners, including natural foods such as honey, molasses and sugar, and artificial products such as sucralose are zero-rated. Prepared mixes, sauces, soups, and cakes used as ingredients at home are zero-rated.

Four Resources on Milk in the CACFP

VAT on food supplied in the course of catering. You must always standard rate food supplied in the course of catering (subject to the rules on the temporary 5% reduced rate of VAT that will apply between 15 July 2020 and 31 March 2021) including hot take-away food. Further information can be found in VAT Notice 709/1: catering and take-away food.

Pearl's Powder My Dairy Intolerance

Some members of parliament have opposed Treasury's proposal to introduce a 16 per cent value-added tax on bread and milk. The proposal was revealed by the Treasury Cabinet Secretary Njuguna Ndung'u on Wednesday, who said having bread and milk as zero-rated products has failed to cushion the poor.

INFOGRAPHIC 19 food items you will not pay VAT for

This kind of milk can last 2 to 3 weeks in your refrigerator. With vat pasteurization, milk is held at 145ºF for 30 minutes and then quickly cooled. This retains a high percentage of the milk's natural enzymes and beneficial bacteria which adds to the flavor and heath benefits of the milk. It lasts about as long in your refrigerator as HTST.

Milk Cartoon Clipart Hd PNG, Cartoon Milk Png Download, Milk Packaging

HMRC's VAT Notice 701/14: food explains what types of foods are zero rated and standard rated for VAT. The notice includes many examples of different food categories.. Exceptions that are zero rated include milk and milk drinks, tea, maté, herbal tea, coffee and cocoa, preparations of yeast, meat and egg. Potato crisps roasted or salted.

what do you know

Thursday, March 14, 2024. By JULIANS AMBOKO. The Treasury is considering introducing a 16 percent value-added tax (VAT) on bread and milk in a fresh push to boost revenue collections from middle-class households. Treasury Cabinet Secretary Njuguna Ndung'u said that studies by government agencies had shown that the current structure where VAT.

Whole Milk Model Dairy

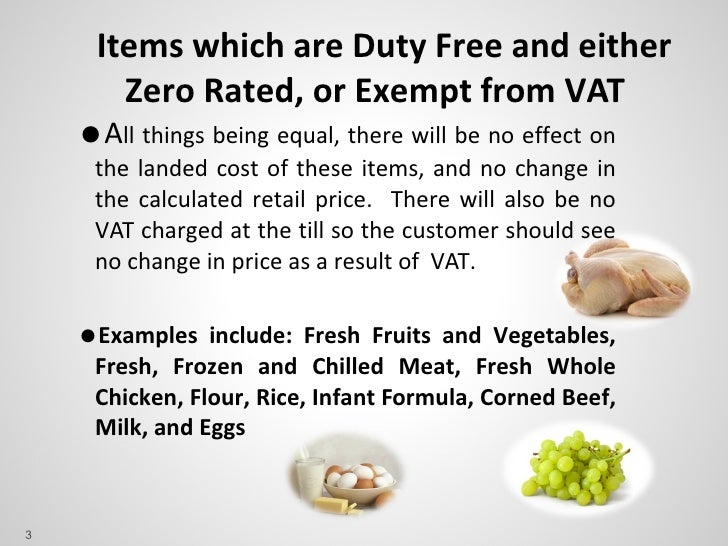

VAT is a tax imposed on goods & services at every production and distribution step. In many countries, basic food items like fruits, vegetables, and some unprocessed goods may be exempt or subject to reduced VAT rates. However, processed or luxury food items often face higher VAT rates.

Milk vat YouTube

This includes both plain and flavoured varieties of soya, pea, oat, almond, and rice milk. VAT on milk-based alcoholic beverages. VAT is charged at the standard rate of 20% on all alcoholic beverages, including those which are milk-based. You can learn more about the VAT treatment of alcoholic beverages in our recent blog on the topic.

Milk Cow Outfitters Dickinson ND

VAT on plant-based milk: 0% . VAT on conventional milk: 0%. Until recently, plant-based milk in Spain was subject to 10% VAT, more than double the 4% applied to conventional milk. However, this disadvantage was removed at the start of 2023 as part of a broader package seeking to tackle rising food prices, which scrapped VAT on essential foods.

FileCononut milk.JPG

In Germany, VAT on cow's milk was 7%, compared to soya milk which incurred a VAT of 19%, in Spain, the rate is 150% higher, and in Italy, soya milk had a VAT rate 450% higher than cow's milk. ProVeg International finds such fiscal variance 'discriminatory', arguing that 'people want a fair playing field for plant-based products'.