Accounts Receivable Dashboard Excel Template Free Printable Templates

Receivables Management Performance Management Employee Management System Turnkey Projects Cpb

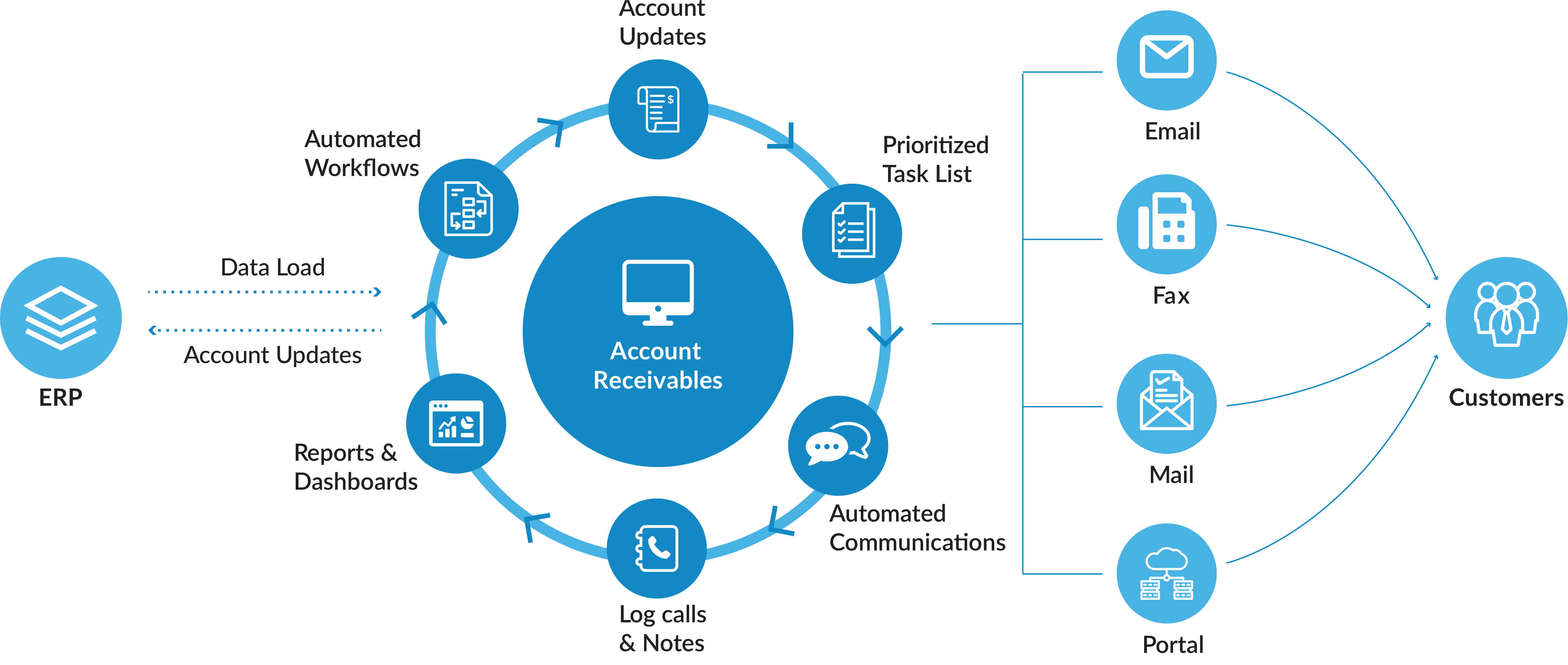

Accounts receivable management is the process by which a business oversees and administers the collection of outstanding payments from its customers.. Automatically process and analyze critical information such as sales and payment performance data, customer payment trends, and DSO to better manage risk and develop strategies to improve.

Accounts Receivable Dashboard Excel Template Free Printable Templates

Fitch looked to pre- and post-pandemic performance as well as the current macroeconomic environment to set the base case default assumption. Rating Stress Reflects Subprime Collateral: The Conn's 2024-A receivables pool has a weighted average (WA) FICO score of 621 and 8.6% of the loans have scores below 550 or no score.

How to Improve Your Receivables Performance Management Through Automation

Receivables Performance Management isn't a scam. They're a legitimate debt collector, and they're accredited by the Better Business Bureau. Contact information for RPM is: Address: 20818 44 th Ave. W, Suite 140, Lynwood, WA 98036; Phone number: 866-269-9306;

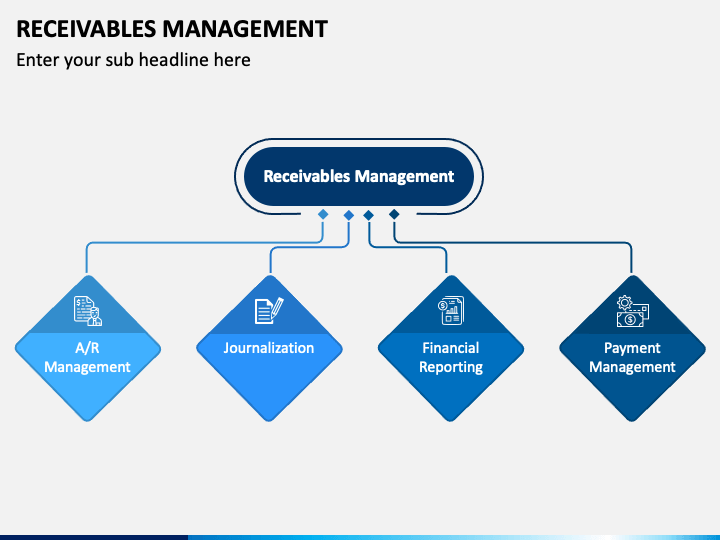

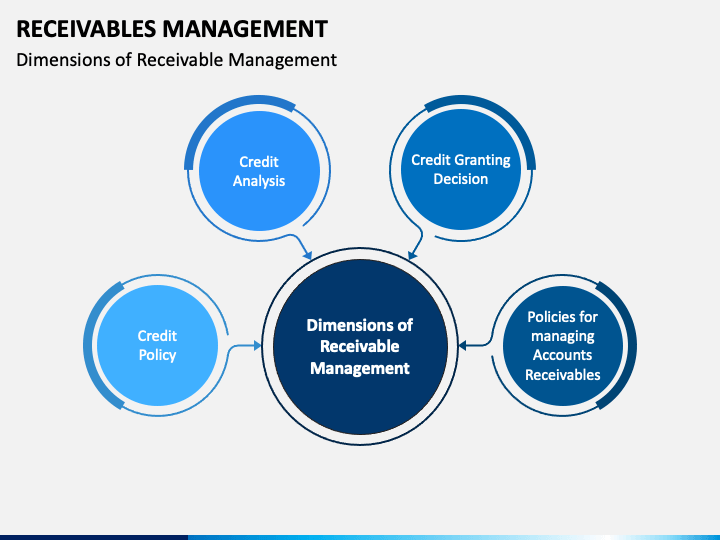

Receivables Management PowerPoint Template PPT Slides

A proposed class action claims the failure of Receivables Performance Management (RPM) to properly secure the private information of approximately 3.7 million customers is to blame for a 2021 data breach. The 21-page case alleges that the Washington-based debt collection company exposed the names, Social Security numbers and other personally.

Account Receivable Management Dashboard With Various KPIs Presentation Graphics Presentation

If you believe Receivables Performance Management has used any of these tactics to get you to pay a debt, file a complaint with the FTC through their online platform, or call 877-382-4357. Or, you can submit a complaint through the CFPB website or by calling 855-411-2372.

Receivables Management SailfinSRM

Efficient receivables performance management is an intricate process that involves clear communication, data-driven insights, streamlined processes, compliance adherence, and continuous adaptation. By implementing a holistic approach that encompasses these strategies, businesses can significantly improve cash flow, minimize delinquencies, and.

Receivables Management Process flow and Solutions Wise, formerly TransferWise

Understanding DSO, DDO, and Other Accounts Receivable KPIs. A/R turnover - the credit-to-cash cycle - and working capital are critical to your business, so it is essential to monitor the Key Performance Indicators (KPIs) and other metrics that track your company's credit, collections, and deduction management health.. In addition, businesses have become more complex, so receivable.

Receivables Performance Management

Receivables performance management often requires a spectrum of functional capabilities, varying from company to company. While six critical capabilities may be imperative for most, each organization has its distinct financial ecosystem thus requiring tailor-fit solutions. Hence, effectively identifying what your business needs is a paramount.

Receivables Performance Management Reviews 3 Key Benefits of Outsourcing Account Receivable

Receivables Performance Management provides debt collection services across various sectors, including auto finance, bankcard and financial, commercial, healthcare, retail, state and local government, telecommunications, and utilities. Is Receivables Performance Management legit or a scam? Receivables Performance Management is a legitimate company.

Receivables Management PowerPoint Template PPT Slides

Receivables Performance Management, LLC . Address: 20818 44th Ave W., Suite 140, Lynnwood, WA 98036. Postal Address: PO Box 1548, Lynnwood, WA 98046. If you received a communication from Receivables Performance Management, LLC regarding an account, please note the account has since been closed in our office. You will no longer receive any.

What is receivable management and its objectives with effective factor Times Darpan

Regardless of the method used, when it comes to business debt collections and accounts receivable management, efficiency is the name of the game. The sooner companies can receive payment on goods and services rendered, the better it is for their bottom line.

RECEIVABLES PERFORMANCE MANAGEMENT REVIEWS BLOG

Receivables Performance Management LLC is an accounts receivable company based in Lynnwood, Washington and works with companies in all industries, including healthcare, retail card, credit card, auto finance, utilities and more. RPM DATA BREACH EXPLAINED.

Receivable Management Receivable Management in 2021 Prosoftly

How ADD measures AR management performance . Average days delinquent (ADD) measures how late customer payments are on average at a particular moment in time. This metric only looks at late payments.. BPDSO = (Current Accounts Receivables / Total Net Credit Sales) x Number of Days in Period; To calculate average days delinquent, simply.

Receivables Performance Management Lynnwood, Washington about.me

Importance: A high AR turnover ratio reflects good receivables management. It means that you collect payments and cycle through AR more frequently, improving your cash flow.. How to Improve Receivables Performance. Improving your accounts receivable involves not only tracking the right metrics but also using best practices. With the right.

Remove Receivables Performance Management from Credit Report

Managing accounts receivables effectively is crucial for any company aiming to run a successful business. The key to successful AR management is understanding and tracking key accounts receivable metrics. By monitoring the right metrics, you gain valuable insights into your company's financial health, customer payment behavior, and collections efficiency.

The Importance of Actively Managing Your Accounts Receivable Rocket Receivables

Adopting key performance indicators (KPI) and defined metrics is also important. For instance, by adding working capital metrics to your standard revenue and profit tracking reports, you'll get a clear picture on items like days sales outstanding (DSO), the percentage of customers who pay late, the number of invoices or customers passed